Topic: Improved Tax Collection

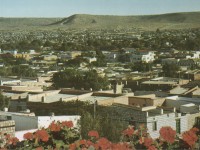

Location: Hargeisa, Somaliland

Participants: Municipality of Hargeisa; UN-Habitat

Project: With UN-Habitat support, the city of Hargeisa established a new property tax billing system. The project involved:

- Developing a GIS-based property tax system;

- Creating a record of all the buildings on the base map;

- Conducting a household survey that updated property attributes and verified the spatial map;

- Integrating the spatial and household databases;

- Generating unique identifiers for each building;

- Determining property tax rates and generating property tax bills.

The local authority gives hard copies of property tax bills – each of which has a photo of the property – and neighborhood maps once a year to each of the five municipal district offices. Trained municipal district staff continually verify bill information in the field, and the GIS support office updates the database as needed. Households get a receipt when they have paid.

In 2006, when the new GIS-based property tax system became operational, property tax revenue for Hargeisa Municipality rose by 43% to US$242,000, despite collection from less than 40% of taxable properties. In 2007, the local council conducted a media campaign and community meetings. Property tax revenue increased by another 70% to US$412,000 in 2007 and US$589,000 by 2008.

In 2007, Hargeisa Municipality started a public infrastructure and services investment program together with Hargeisa residents. Through this program, the municipality has spent US$320,000 to rehabilitate two roads and US$80,000 to construct a bridge. Hargeisa is expanding rapidly, and maintaining and updating the property database is costly. With continued technical support from development partners, the local council needs only to allocate a small percentage of the revenues towards this cost.

Source: “Best Practices – Africa Field Report” in UN-Habitat’s Urban World, Vol. 1 (3), 2009.